Local council farm rate concessions

Properties which are classified as working commercial farms may be eligible for a rebate on their 2023-2024 farm rates. Rebates and rates may differ depending… from Local council farm rate concessions

What is it?

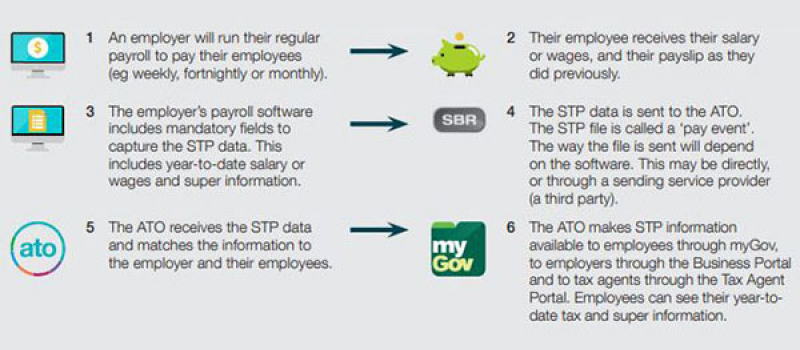

Single Touch Payroll (STP) is a reporting process set up by the Australian Tax Office (ATO) to ensure the accuracy and timeliness of organisations’ payroll processes. STP communicates payroll, tax and superannuation information from your payroll software to the ATO. This new reporting process is a legal requirement for all employers.

How does it work?

Your payroll software will need to be made STP ready in order to send the relevant information to the ATO. This means including mandatory fields to capture the STP data. This will include information such as year-to-date salary or wages and super. The STP data is then sent to the ATO either directly or through a sending service provider (depending on your software capabilities).

Who needs to do it?

All employers are required to be STP compliant. The deadlines are as follows:

Over 20 employees

Should be registered and compliant already (Start date was 1 July 2018).

Please contact us immediately if you’re not using STP or your software isn’t supporting STP.

Under 20 employees

Need to be STP ready by 1 July 2019.

If you are already using live accounting software such as MYOB, Xero, Quickbooks then please check you are compliant and ready to start reporting.

If you are not currently on a live version or using a compliant software system please contact us to discuss your options and we can assist you with transitioning to a software system which is STP compliant.

Micro employees (1 to 4 employees)

The ATO will offer help to micro employees in the transition process with alternative options such as initially allowing us (West Carr & Harvey) to report quarterly on your behalf rather than each time you run your payroll.

Please feel free to contact us if you have any questions.

Useful links:

ATO – STP for small employers

ATO – Transition to STP for small employers